Hulu An Evil Plot To Destroy The World Case Analysis

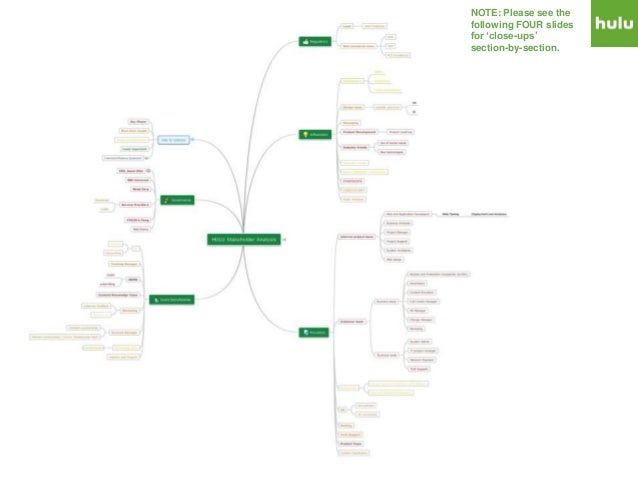

Vrio analysis for Hulu An Evil Plot To Destroy The World case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable.

Harvard Case Study AnalysisWhat is an ANALYSIS?analysis Function: noun Inflected Form(s): plural analyses - s z Etymology: New Latin, from Greek, from analyein to dissolve (from ana- + lyein to loosen, dissolve) + -sis -1: separation or breaking up of a whole into its fundamental elements or component parts 2 a: a detailed examination of anything complex (as a novel, an organization, a race) made in order to understand its nature or to determine its essential features: a thorough study.Premium Case study, Marketing, Strategic management 488 Words 4 Pages. All quotations and references refer to “ Hulu: An Evil plot to Destroy the World” unless otherwise noted.1) Hulu succeeded while everyone predicted its failure due to the following reasons:. Hulu harnessed existing technologies namely online video and broadcast media to create a new platform that was “focused on helping users find and enjoy the world’s premium, professionally produced content when where and how they want it”. The platform brought together professional content owners/providers.Premium Advertising, Computer security, First-mover advantage 1062 Words 4 Pages. Harvard Case Review and Analysis1. Jeff Immelt’s strategies for GE were solid in a theoretical sense.

The company should have been delivering above-average returns and seen all the positives that he preached about it. The reason this did not happen and they faced some humiliation in 2008 until 2010 were due to GE Capital. Immelt thought that they were diversified enough to survive the economic downturn. However this proved to be wrong. In an interview for BusinessWeek magazine David Magee.Premium Companies based in Fairfield County, Connecticut, Credit rating, Financial crisis 1581 Words 4 Pages. Sustain the brand position and image that it has today. As a global seller of high end luxury cars, BMW is in a competitive industry where strategic marketing activities are a key aspect in setting a company apart in an industry.

For this particular case, BMW’s Jim McDowell sits in front of a very important decision on what his next step will be in following their “The Hire” short film series marketing campaign. In making this decision, many factors have to be taken into consideration. One is whether.Premium Marketing, Feature film, BMW 1122 Words 4 Pages. Module Title: Cases in MarketingBanner Code: 07 15824Lecturer: Inci ToralAssignment Title: Case Study: Target the Right MarketWord Count: 1246ID number: 1291160, 1207270, 1249898, 1228189 and 1259957An essay Submitted toGraduate Diploma in Business Administration Year 2, 2013Birmingham, United Kingdom11th, March 2013IntroductionThis report explores case study of SparkPlace that was originally influenced by the case of HubSpot: Inbound Marketing and Web 2.0 (Steenburgh.Premium Business, Business school, Harvard Business School 1879 Words 7 Pages. CASE ANALYSISPrepare a case analysis on the topic of Strategic Management. The case analysis should be a minimum of three pages long, double spaced. Check for correct spelling, grammar, punctuation, mechanics, and usage.

Citations should use APA style.Case Analysis Question: What is Strategic Management and why is it critical to the success of an organization in meeting its goals and mission?Your analysis of this case and your written submission should reflect an understanding of the.Premium Apple Inc., IPhone, IPod 818 Words 4 Pages. Case Analysis Guidelines & SuggestionsContent: Your case write-up should focus on and answer all the key questions in the syllabus – do not omit any of the questions. The length limitation on this paper is short, so please jump right into answering the questions.

There is no need to summarize your points in the beginning or to review what happens in the case. You must use your own judgment as to which questions need more space than others, however, remember that all claims or recommendations.Premium Case, Case analysis, Florida Keys 1126 Words 4 Pages.

CASE STUDY ANALYSIS FORMAT( Case study analysis are written as report in structured format with relevant headings)A. Case Title: (Title based on the given case study)B. Time Framework: (Range of years or time period where the case occur)C. Entrepreneurship Topic: (State the main topics relevant to Business Opportunity that are demonstrated in the case study.)D. Statement of the Problem/s (Discussion or case questions): (Questions provided by the case study will be enumerated here.Premium Case study, Logic, Scientific method 536 Words 3 Pages.

Harvard Business Case: DucatiIntroductionAfter the introduction of Federico Minoli, Ducati has transformed from a company on the verge of bankruptcy into one of the most profitable motorcycle manufacturers in the world. But this is not enough for Minoli, who currently considers entering the Harley Davidson niche: introducing a Ducati cruiser. However, according to the analysis below – prepared using some basic strategic questions - this would not be a very.Premium Buell Motorcycle Company, Competition, Desmodromic valve 734 Words 3 Pages.

Introduction to Net Present Value (NPV) - What is Net Present Value (NPV) ? How it impacts financial decisions regarding project management?

NPV solution for Hulu: An Evil Plot to Destroy the World? case study

At Oak Spring University, we provide corporate level professional Net Present Value (NPV) case study solution. Hulu: An Evil Plot to Destroy the World? case study is a Harvard Business School (HBR) case study written by Anita Elberse, Sunil Gupta. The Hulu: An Evil Plot to Destroy the World? (referred as “Hulu Online” from here on) case study provides evaluation & decision scenario in field of Sales & Marketing. It also touches upon business topics such as - Value proposition, Internet, Marketing.

The net present value (NPV) of an investment proposal is the present value of the proposal’s net cash flows less the proposal’s initial cash outflow. If a project’s NPV is greater than or equal to zero, the project should be accepted.

NPV = Present Value of Future Cash Flows LESS Project’s Initial Investment

Case Description of Hulu: An Evil Plot to Destroy the World? Case Study

To maximize their effectiveness, color cases should be printed in color.In July 2009, Jason Kilar, the chief executive officer of Hulu, is debating whether the online video aggregator should move away from a purely advertising-supported model, and whether it should participate in an industry-wide initiative to develop and test 'authentication' technology that can facilitate a subscription or pay-per-view model. The case traces the early years of Hulu, a joint venture between News Corp. and NBC Universal, that was initially met with strong skepticism but quickly became on the most celebrated and popular online video business. Provides in-depth information on how the company serves content owners, users, and advertisers. Describes the online video space in considerable detail, also covering economic and viewership statistics that enable a rich discussion of viable business models. Topics Include: Advertising Media, Business models, Digital Technology, Distribution Channels, Internet, Online Media, Television and Videos.

Case Authors : Anita Elberse, Sunil Gupta

Topic : Sales & Marketing

Related Areas : Internet, Marketing

Calculating Net Present Value (NPV) at 6% for Hulu: An Evil Plot to Destroy the World? Case Study

| Years | Cash Flow | Net Cash Flow | Cumulative Cash Flow | Discount Rate @ 6 % | Discounted Cash Flows |

|---|---|---|---|---|---|

| Year 0 | (10008189) | -10008189 | - | - | |

| Year 1 | 3443399 | -6564790 | 3443399 | 0.9434 | 3248490 |

| Year 2 | 3954058 | -2610732 | 7397457 | 0.89 | 3519098 |

| Year 3 | 3939893 | 1329161 | 11337350 | 0.8396 | 3308010 |

| Year 4 | 3244034 | 4573195 | 14581384 | 0.7921 | 2569579 |

| TOTAL | 14581384 | 12645176 |

The Net Present Value at 6% discount rate is 2636987

In isolation the NPV number doesn't mean much but put in right context then it is one of the best method to evaluate project returns. In this article we will cover -

Different methods of capital budgeting

What is NPV & Formula of NPV,

How it is calculated,

How to use NPV number for project evaluation, and

Scenario Planning given risks and management priorities.

Capital Budgeting Approaches

Methods of Capital Budgeting

There are four types of capital budgeting techniques that are widely used in the corporate world –

1. Net Present Value

2. Internal Rate of Return

3. Payback Period

4. Profitability Index

Apart from the Payback period method which is an additive method, rest of the methods are based on Discounted Cash Flow technique. Even though cash flow can be calculated based on the nature of the project, for the simplicity of the article we are assuming that all the expected cash flows are realized at the end of the year.

Discounted Cash Flow approaches provide a more objective basis for evaluating and selecting investment projects. They take into consideration both –

1. Timing of the expected cash flows – stockholders of Hulu Online have higher preference for cash returns over 4-5 years rather than 10-15 years given the nature of the volatility in the industry.

2. Magnitude of both incoming and outgoing cash flows – Projects can be capital intensive, time intensive, or both. Hulu Online shareholders have preference for diversified projects investment rather than prospective high income from a single capital intensive project.

Formula and Steps to Calculate Net Present Value (NPV) of Hulu: An Evil Plot to Destroy the World?

NPV = Net Cash In Flowt1 / (1+r)t1 + Net Cash In Flowt2 / (1+r)t2 + … Net Cash In Flowtn / (1+r)tn

Less Net Cash Out Flowt0 / (1+r)t0

Where t = time period, in this case year 1, year 2 and so on.

r = discount rate or return that could be earned using other safe proposition such as fixed deposit or treasury bond rate. Net Cash In Flow – What the firm will get each year.

Net Cash Out Flow – What the firm needs to invest initially in the project.

Step 1 – Understand the nature of the project and calculate cash flow for each year.

Step 2 – Discount those cash flow based on the discount rate.

Step 3 – Add all the discounted cash flow.

Step 4 – Selection of the project

Why Sales & Marketing Managers need to know Financial Tools such as Net Present Value (NPV)?

In our daily workplace we often come across people and colleagues who are just focused on their core competency and targets they have to deliver. For example marketing managers at Hulu Online often design programs whose objective is to drive brand awareness and customer reach. But how that 30 point increase in brand awareness or 10 point increase in customer touch points will result into shareholders’ value is not specified.

To overcome such scenarios managers at Hulu Online needs to not only know the financial aspect of project management but also needs to have tools to integrate them into part of the project development and monitoring plan.

Calculating Net Present Value (NPV) at 15%

After working through various assumptions we reached a conclusion that risk is far higher than 6%. In a reasonably stable industry with weak competition - 15% discount rate can be a good benchmark.

| Years | Cash Flow | Net Cash Flow | Cumulative Cash Flow | Discount Rate @ 15 % | Discounted Cash Flows |

|---|---|---|---|---|---|

| Year 0 | (10008189) | -10008189 | - | - | |

| Year 1 | 3443399 | -6564790 | 3443399 | 0.8696 | 2994260 |

| Year 2 | 3954058 | -2610732 | 7397457 | 0.7561 | 2989836 |

| Year 3 | 3939893 | 1329161 | 11337350 | 0.6575 | 2590544 |

| Year 4 | 3244034 | 4573195 | 14581384 | 0.5718 | 1854787 |

| TOTAL | 10429426 |

The Net NPV after 4 years is 421237

(10429426 - 10008189 )

Calculating Net Present Value (NPV) at 20%

If the risk component is high in the industry then we should go for a higher hurdle rate / discount rate of 20%.

| Years | Cash Flow | Net Cash Flow | Cumulative Cash Flow | Discount Rate @ 20 % | Discounted Cash Flows |

|---|---|---|---|---|---|

| Year 0 | (10008189) | -10008189 | - | - | |

| Year 1 | 3443399 | -6564790 | 3443399 | 0.8333 | 2869499 |

| Year 2 | 3954058 | -2610732 | 7397457 | 0.6944 | 2745874 |

| Year 3 | 3939893 | 1329161 | 11337350 | 0.5787 | 2280031 |

| Year 4 | 3244034 | 4573195 | 14581384 | 0.4823 | 1564445 |

| TOTAL | 9459849 |

The Net NPV after 4 years is -548340

At 20% discount rate the NPV is negative (9459849 - 10008189 ) so ideally we can't select the project if macro and micro factors don't allow financial managers of Hulu Online to discount cash flow at lower discount rates such as 15%.

He received a special scholarship to attend Columbia without first completing high school. Leaving the scientific arena, Herbert worked at Time Magazine in New York City before launching a free lance writing career that eventually evolved into a nationally syndicated newspaper column called Thoughts For Success. Graduating from Columbia University with a BA degree, majoring in physics, Mr. Harris did research in theoretical and high energy physics.

Acceptance Criteria of a Project based on NPV

Simplest Approach – If the investment project of Hulu Online has a NPV value higher than Zero then finance managers at Hulu Online can ACCEPT the project, otherwise they can reject the project. 96 movie songs download mp3. This means that project will deliver higher returns over the period of time than any alternate investment strategy.

In theory if the required rate of return or discount rate is chosen correctly by finance managers at Hulu Online, then the stock price of the Hulu Online should change by same amount of the NPV. In real world we know that share price also reflects various other factors that can be related to both macro and micro environment.

In the same vein – accepting the project with zero NPV should result in stagnant share price. Finance managers use discount rates as a measure of risk components in the project execution process.

Sensitivity Analysis

Project selection is often a far more complex decision than just choosing it based on the NPV number. Finance managers at Hulu Online should conduct a sensitivity analysis to better understand not only the inherent risk of the projects but also how those risks can be either factored in or mitigated during the project execution. Sensitivity analysis helps in –

Understanding of risks involved in the project.

What can impact the cash flow of the project.

What will be a multi year spillover effect of various taxation regulations.

What are the key aspects of the projects that need to be monitored, refined, and retuned for continuous delivery of projected cash flows.

What are the uncertainties surrounding the project Initial Cash Outlay (ICO’s). ICO’s often have several different components such as land, machinery, building, and other equipment.

Some of the assumptions while using the Discounted Cash Flow Methods –

Projects are assumed to be Mutually Exclusive – This is seldom the came in modern day giant organizations where projects are often inter-related and rejecting a project solely based on NPV can result in sunk cost from a related project.

Independent projects have independent cash flows – As explained in the marketing project – though the project may look independent but in reality it is not as the brand awareness project can be closely associated with the spending on sales promotions and product specific advertising.

References & Further Readings

Anita Elberse, Sunil Gupta (2018), 'Hulu: An Evil Plot to Destroy the World? Harvard Business Review Case Study. Published by HBR Publications.